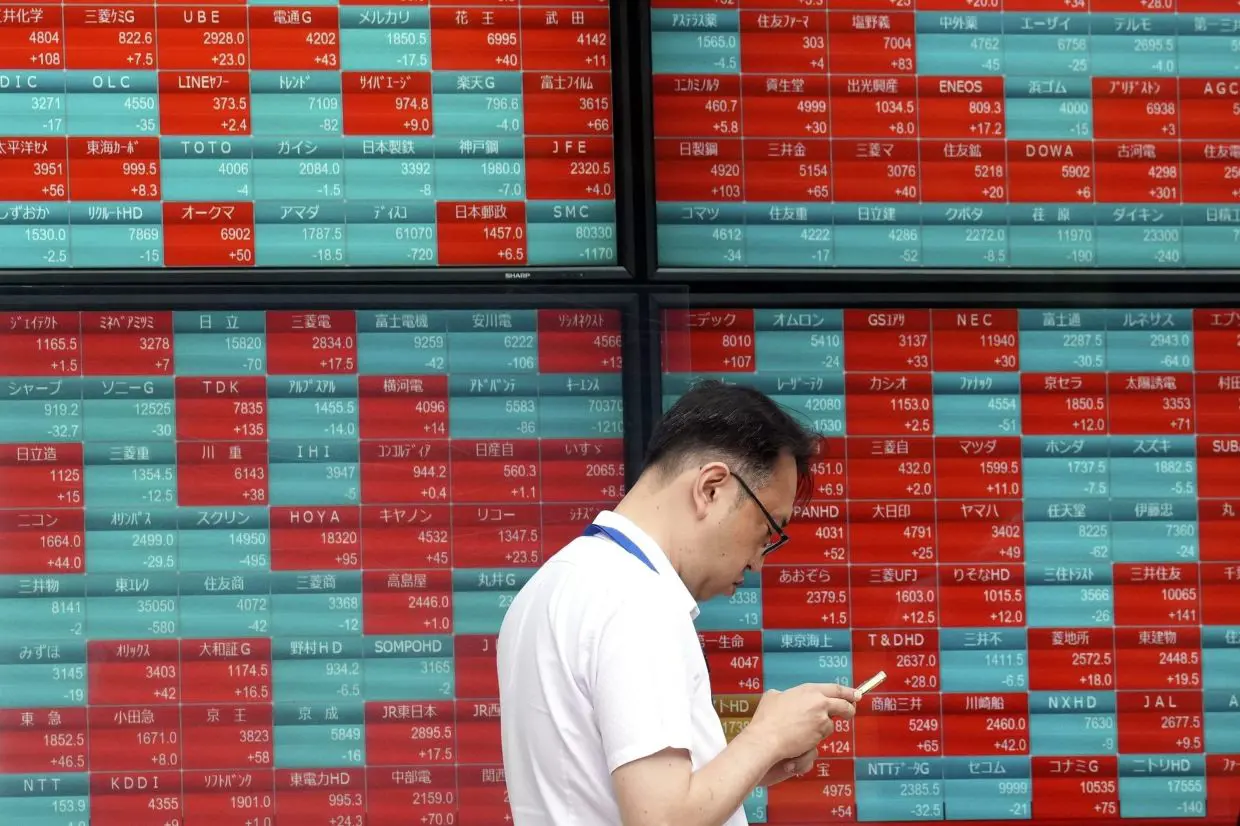

Markets Start Weak Today

First, Asian stock markets opened lower today. In addition, many investors felt worried. As a result, share prices dropped quickly. Selling started early, and meanwhile, buying slowed down. Also, people watched numbers closely. Red numbers appeared everywhere. Therefore, confidence felt weak. Furthermore, hope for gains became small. Traders checked news constantly, and finally, the day stayed weak.

What Asian Stocks Mean

Asian stocks are company shares in Asia. In addition, people buy and sell them daily. As a result, prices can rise or fall. Today, prices fell, and because of this, people felt sad. Money lost value, so traders felt nervous. Also, small changes caused worry. Therefore, some stayed silent. The market mood was tense, and everyone wanted safety. In short, Asian stocks affect many investors.

Fear Controls the Market

Next, investors felt unsure about the future. Many worried about profits, and as a result, they sold shares quickly. Consequently, fear spread fast. Confidence dropped in all sectors. Therefore, traders became careful. In addition, they avoided risky stocks. Worries influenced decisions, and markets followed fear. Also, every negative news caused pressure. As a result, selling dominated the market.

Tech Companies Fall First

Then, tech stocks fell the most today. In particular, AI companies lost value quickly. Also, investors worried about slow growth. Prices of big tech firms dropped. Small tech firms also fell, and as a result, tech weakness pulled markets down. Therefore, traders reduced tech positions. Losses affected other sectors. Furthermore, the mood in tech was bad. Consequently, fear increased, and tech was the main drag.

Why People Fear AI

AI means smart machines. However, profits from AI may take time. Companies spent a lot on AI, so investors doubted quick returns. In addition, they wondered if AI would grow. Costs stayed high, and earnings looked small. Therefore, traders wanted safety. AI fear caused selling. In short, uncertainty dominated the sector. Also, many investors avoided AI stocks.

China Gives Weak Data

Meanwhile, China shared economic numbers this week. Factories produced less, and shops sold less. Because growth slowed, investors worried. Furthermore, the slowdown affected other markets. China’s news is very important. As a result, Asian markets reacted fast. In addition, sentiment became cautious. Traders changed strategies. Also, investors became more careful. Overall, weak China data added pressure.

China’s Slowdown Hurts Asia

Many countries trade with China. When China slows, others feel it. Companies earn less money. Exports and imports face trouble. Therefore, investors worry about demand. Markets face more pressure. Also, confidence drops when growth slows. The effect spreads across sectors. As a result, traders watch China closely. Consequently, Asia’s markets stay sensitive.

Investors Become Careful

After that, investors stopped buying risky stocks. They sold shares to save money. Patience grew, and safe investments became popular. Traders waited for signals. They studied news carefully. As a result, risk-taking decreased. Capital protection was key. Also, traders avoided sudden moves. Global news was important. Therefore, calm and caution stayed strong.

Tech Shares Drop the Most

Also, tech stocks lost the most today. AI, software, and chip stocks fell. Small tech firms also dropped. Consequently, losses pulled indices down. Traders felt nervous, and red numbers appeared everywhere. Confidence in tech fell. Selling affected other markets. As a result, fear spread fast. Some investors left tech. Overall, tech losses were heavy.

Markets Are Waiting Now

Now, markets are holding for the moment. Traders wait for good news. Reports and data are watched. Investors hope for recovery signs. However, the economy is uncertain. Sentiment depends on news. Confidence may return if data is good. Many investors wait. Trading is slow. Also, patience is important. Time will show trends.

Simple End of the Story

Finally, Asian stocks fell today. AI fears and weak China data caused it. Investor confidence stayed low. Selling dominated tech and other sectors. Prices moved down fast. However, hope for recovery exists. Future news may help. Traders stay careful. Small improvements may lift markets. Today was a warning. Tomorrow is important.